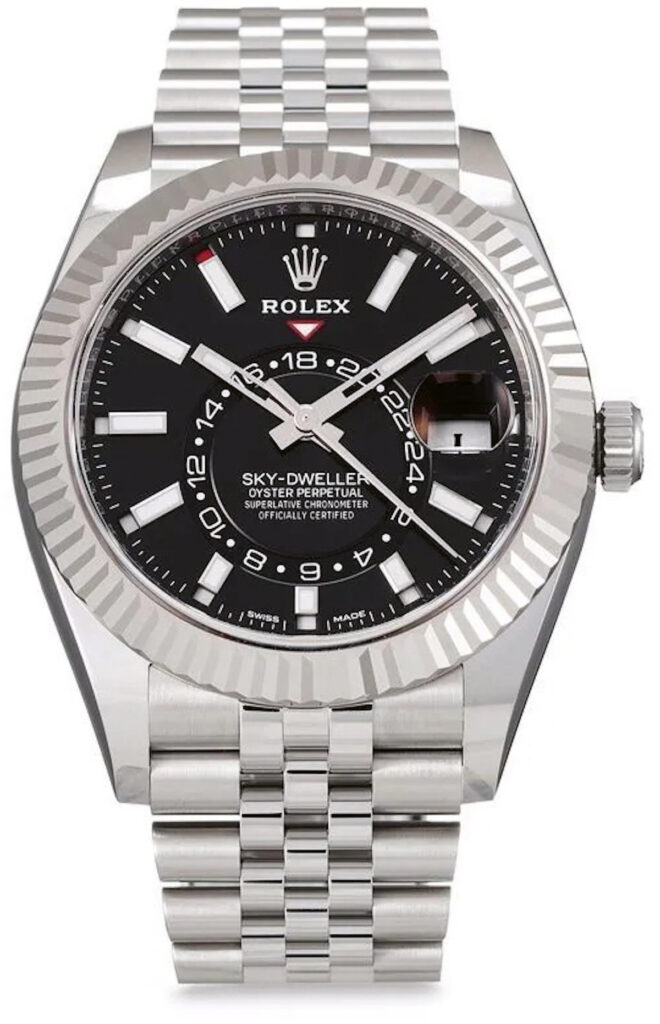

Founded in 1905, Rolex never stays out of the public eye. As James Bond’s favourite watch brand, it remains prominent in popular culture and has a long association with the late actor Paul Newman – the Cosmograph Daytona style he favoured has become one of the most sought-after by collectors, and the model he personally owned reached US$17.8m at auction in 2017, becoming the third most expensive watch in history.

The brand is so popular that those wishing to buy a new Rolex watch are currently on a long waiting list due to constant shortages, while prices on the second-hand market soar. All Rolex watches are designed and manufactured in-house in four factories in Switzerland. They are hand-assembled with the utmost care to meet the brand’s unique and high standards of quality, performance and aesthetics. Rolex sales have been on the rise for years, and not even pandemics and factory closures have been able to halt this trajectory.

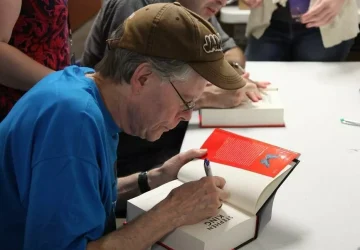

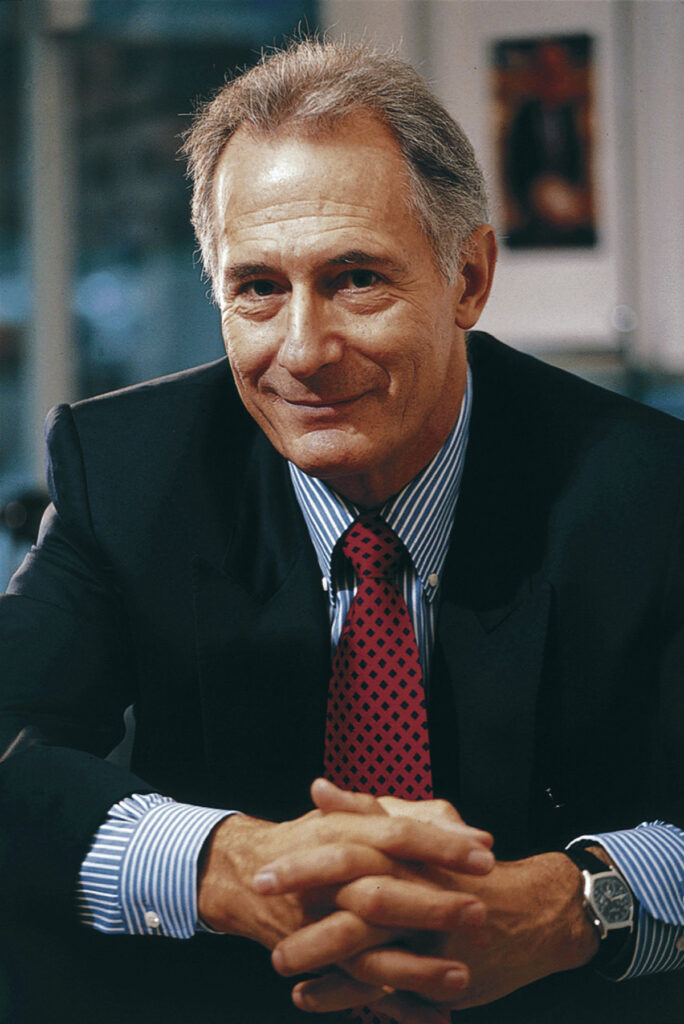

Given its continued popularity, its ability to overcome pandemics and queues, and the booming used watch market, now seems a good time to produce a book about Rolex. Watch expert Osvaldo Patrizzi and journalist Mara Cappelletti have teamed up to produce a new hardcover book, Investing in Wristwatches: Rolex. Written in partnership with Sotheby’s, the book uses much of the auction house’s data. Patrizzi, who worked as a watch restorer in Milan from the age of 13 and founded Antiquorum, the world’s leading auctioneer of modern and vintage watches, in 1974, says: “It is correct to say that the book shows how much each watch has achieved at auction, but it also shows some watches that have not sold, thereby providing information on market trends and how they change over time. By working with Sotheby’s, we are able to show prices for watches with the same reference from the 1980s to the most recent auctions held before the book went to press. We hope it will become a detailed guide for collectors and investors”.

The book is sure to appeal to fans of the Rolex brand, detailing many of its most famous models and series through the ages, such as the Sports and Oyster watches. There are Submariner models dating back to 1955; single-button chronographs from the late 1930s; and the extremely rare Centegraph from 1935, each accompanied by full details of their materials and movements, as well as the dizzying sums for which they were sold at auction. Mention is made of the Gabus chronograph from 1945, while in the 1950s and 1960s the first Cosmograph Daytonas and versions dubbed ‘Paul Newman’ appear, marked by black sub-dials on a white dial (panda effect) and Art Deco typeface. Indeed, it was Patrizzi who is said to have first coined the “Paul Newman” tag, having seen a photograph of the actor in this model in 1990, and it has since been adopted by the entire watchmaking industry. Other Rolex models include the Day-Date, as well as lesser-known models such as the Beta 21 of the 1970s and the rectangular Prince of the 1930s.

Yesterday, today and tomorrow, it seems impossible to stop Rolex’s enduring popularity, as Patrizzi says. “Rolex watches represent the ultimate in design and technical excellence,” he says. “As for me, I appreciate the stylish, sports-inspired design, the high quality of the products and their reliability, and this maintains interest in the collector community. They certainly haven’t lost in value during the pandemic.”

For those on the waiting list now, there may be some relief in the fact that their purchase could prove very valuable in the future. The 2021 range includes the Explorer II with an updated 42mm case and ‘Chromalight’ luminescent material, exclusive to Rolex; the 36mm two-tone Oyster Perpetual Explorer in silver and gold, with a striking lacquered black dial; four Oyster Perpetual Datejust 36 models, with striking motifs on the dial; and the new 40mm Cosmograph Daytonas with meteorite dials and black chronograph counters, available in various case materials. They seem to meet some of Patrizzi’s criteria for what tends to keep or increase in value. And in general, it seems that watch collecting is staying for a long time, with Rolex remaining one of the most sought-after brands. “The watch investment market has grown considerably since the 1980s,” Patrizzi concludes. “Over the years, the value of watches has risen five, 20 or even more times on average. If you consider that design is the main art form of the 20th century, watches are a perfect example of this. And watches are a universal commodity, their value is recognised all over the world.”